JBCarvalho Pictures

Funding Thesis

Ferrari (NYSE:RACE) is among the world’s most recognizable manufacturers. Based again in 1942 in Italy by Enzo Ferrari, the model has grown to develop into one of many largest automotive producers on the earth. Regardless of the latest turbulence within the financial system, Ferrari continues to indicate sturdy resilience. The corporate’s demographic can be one in all, if not the strongest, because the ultra-rich are a lot much less vulnerable to inflationary strain and financial downturns. Its newest earnings point out sturdy demand and development and the growth of its catalog is probably going to supply additional development alternatives shifting ahead. The corporate has additionally been actively returning money to shareholders by means of buybacks and dividends.

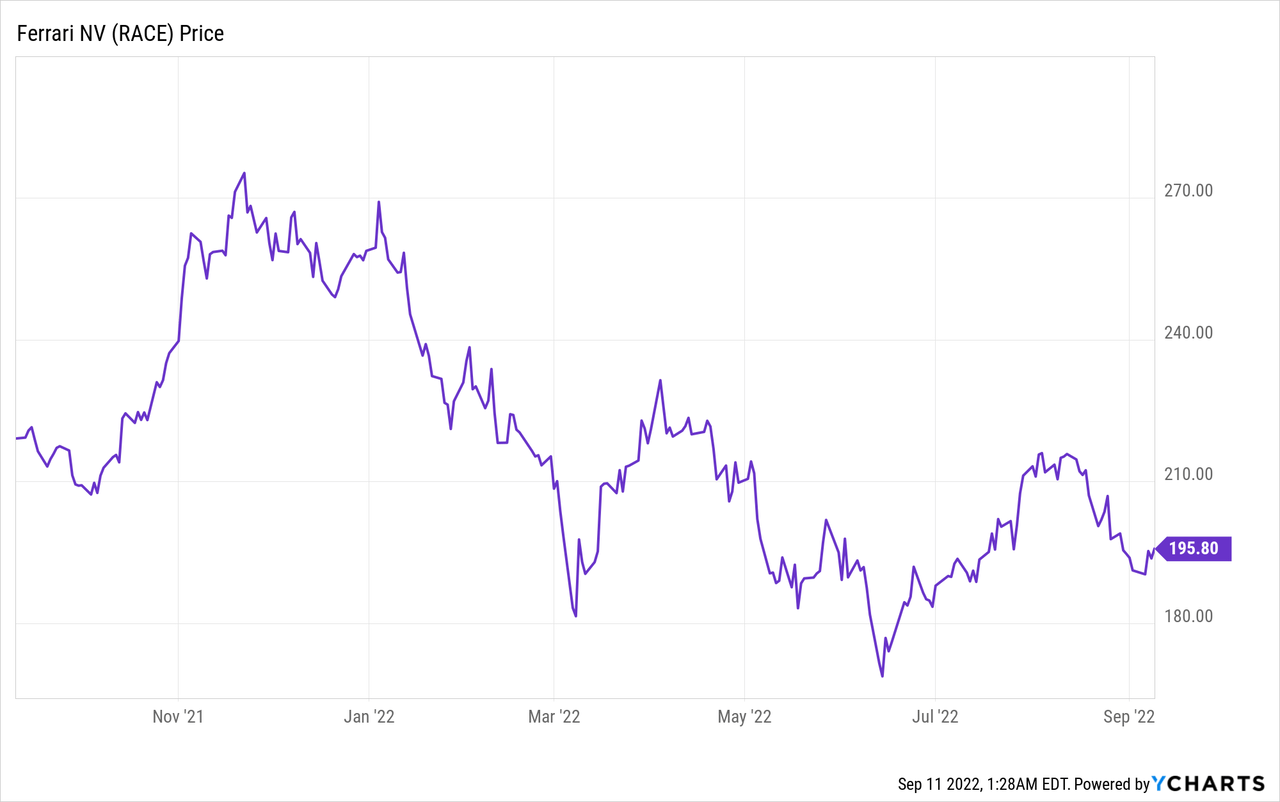

Amid the broad market sell-off, the corporate is now buying and selling virtually 30% under its all-time excessive final 12 months. Nevertheless, regardless of the massive drop in share worth, the ahead P/E ratio of 40 stays very costly. I like the corporate’s prospects however I imagine buyers ought to watch for a greater worth level earlier than dipping in, as the present valuation provides very restricted upside. Subsequently I fee Ferrari as a maintain on the present worth.

Catalog Enlargement

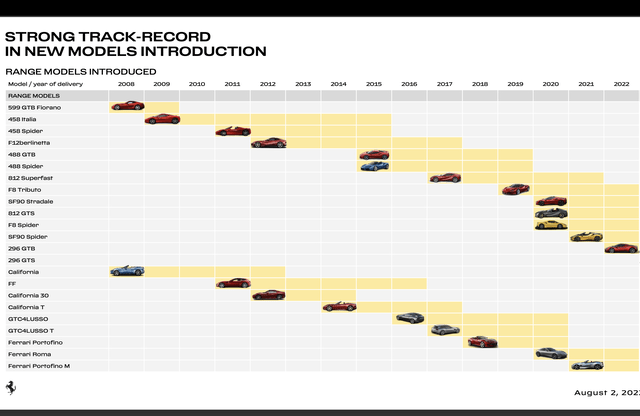

Ferrari’s essential development catalysts embrace the growth of its product portfolio. From the chart under, you possibly can see that the corporate normally introduce 1–2 new vary mannequin and 1–2 new restricted/particular version mannequin annually. Throughout the newest capital market day, the administration workforce introduced that it’ll introduce 15 new automobiles from 2023 to 2026. It is a a lot quicker launch tempo in comparison with prior years. One of many notable launches contains the Purosangue, Ferrari’s first SUV, which is ready to be unveiled later this month. It’s prone to generate some buzz similar to Lamborghini’s Urus.

The corporate can be going to unveil its first absolutely electrical car in 2025, and the long-awaited supercar inside the plan interval. The corporate now expects EVs to account for 40% of its catalog by 2030. These extremely anticipated launches are prone to generate sturdy gross sales for the corporate shifting ahead. The rise within the variety of launches also needs to drive up the overall variety of orders and shipments.

Ferrari

Dividends and Buybacks

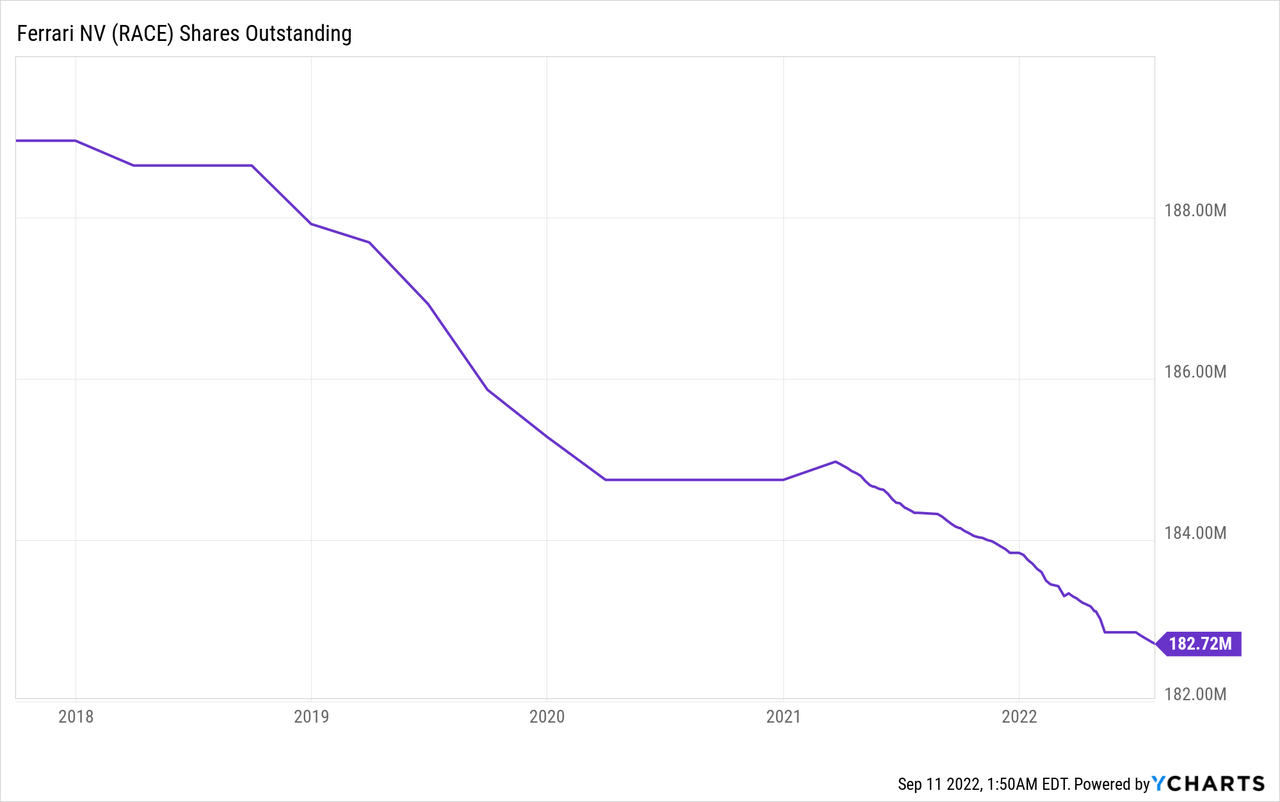

Ferrari has very pleasant shareholder insurance policies. The corporate has been actively returning money to buyers by means of buybacks and dividends, with buybacks being the primary precedence and dividends being the second. Prior to now 5 years, the variety of shares excellent has been coming down persistently, as proven within the chart under. In June, administration introduced the graduation of a brand new share repurchase program of roughly €2 billion (to be executed by 2026), representing virtually 6% of the present market cap. It will seemingly present a lift for the EPS determine shifting ahead.

The corporate additionally began distributing annual dividends in 2017. Earlier this 12 months, it elevated its yearly dividend by 57% to $1.47 per share. Whereas the present yield is just at round 0.75%, I anticipate the dividend will proceed to develop quickly. The present payout ratio is just 26.7% and administration did sign the determine will probably be raised to 35% sooner or later.

Benedetto Vigna, CEO, on dividend and buybacks

Such strong monetary profile permits us to maintain investing for our future development, whereas growing the shareholders’ remuneration with a mix of dividends and share buyback. Dividend payout will probably be elevated to 35% of adjusted web earnings and a €2 billion share repurchase program already began.

Financials

Ferrari’s newest quarterly earnings have been excellent. It beat each the highest and backside line and raised steerage on all metrics. The outcomes are very spectacular when contemplating how risky the financial system had been within the final 12 months.

Benedetto Vigna, CEO, on second-quarter outcomes

Ferrari continues a section of sturdy development, with quarterly file outcomes when it comes to revenues, EBITDA and EBIT. The standard of the primary six months and the robustness of our enterprise permits us to revise upward the 2022 steerage on all metrics. Additionally the web order consumption reached a brand new file degree within the quarter

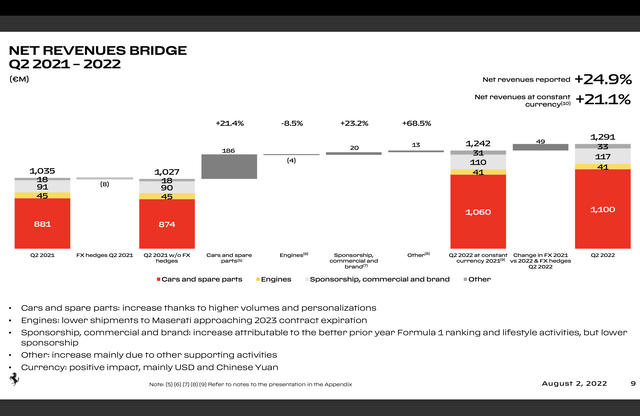

Only a fast observe, all of the figures talked about under on this part will probably be in Euros. Ferrari reported income of €1.29 billion, up 24.9% YoY (12 months over 12 months) from €1.04 billion. The expansion is usually pushed by the sturdy cargo numbers, which have been up 29% from 2,685 items to three,455 items. The cargo for Mainland China, Hong Kong, and Taiwan was up over 110% throughout the quarter. The corporate is constant to see sturdy demand throughout the catalog, particularly for the Portofino convertible and F8 Tributo. Income for sponsorship, business, and the model additionally noticed a 29% improve attributable to higher Method 1 rating and better contribution from life-style actions.

Ferrari

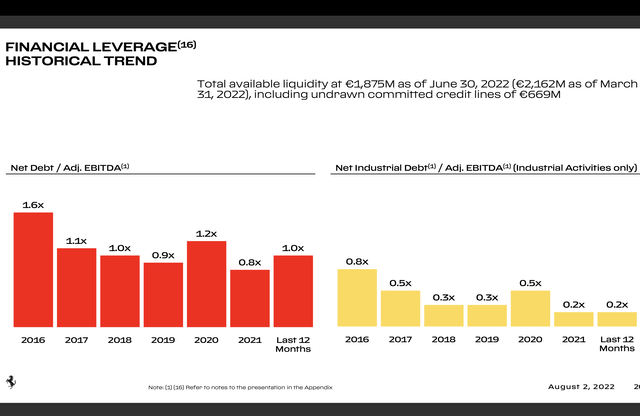

EBITDA for the quarter was €446 million in comparison with €386 million, up 15% YoY. EBITDA margin dipped barely from 37.4% to 34.6%, in keeping with expectations. The drop is basically attributed to the rise in communication and advertising bills. Web revenue was €251 million, up 22% from €206 million. Diluted EPS was 1.36 in comparison with 1.11, up 23%. The corporate’s steadiness sheet stays very wholesome.

It ended the quarter with €2.8 billion in debt and €1.2 billion in debt, representing a web debt / adjusted EBITDA ratio of 1, in keeping with the historic common. The corporate additionally repurchased €150 million price of shares throughout the quarter.

Ferrari

Valuation

Regardless of the 30% drop in share worth. Ferrari stays very costly. The corporate is presently buying and selling at an fwd P/E ratio of 40. There aren’t many manufacturers on the market just like Ferrari so it’s laborious to seek out direct comparisons for valuation. Essentially the most alike firm I can consider is LVMH (OTCPK:LVMHF), which can be one of many world’s most recognizable luxurious manufacturers with a resilient buyer base. Presently, LVMH is buying and selling at an fwd P/E ratio of 27.6. That is a lot decrease and extra cheap in comparison with Ferrari’s. LVMH additionally reported 1H gross sales development of 28.2%, even increased than Ferrari’s 24.9%. A 100% premium in a number of appears to be unjustified in my view. On a historic foundation, the corporate is presently buying and selling in keeping with its 5-year common fwd P/E ratio, as proven within the chart under. The present valuation seems to have already priced in quite a lot of the longer term development and capped the near-term upside.

In search of Alpha

Dangers

I imagine the 2 largest dangers in regard to Ferrari are manufacturing progress and international foreign money. Ferrari has a for much longer meeting time in comparison with different automotive producers. A spread mannequin sometimes takes about three weeks whereas particular editions and supercars can take months. With the present provide chain state of affairs being so risky, it’s doable that the manufacturing of its automobiles could also be delayed. This because of this will cut back the availability of present fashions and even presumably push ahead the launch date for brand new fashions, driving down the variety of shipments within the close to time period. Overseas foreign money is one other potential danger. Most of Ferrari’s income comes from international nations, with the US solely accounting for about 30% of complete shipments. With the greenback persevering with to spike up, the corporate might even see a unfavourable foreign money impression on future earnings. Whereas the corporate does place some foreign money hedges, it’s laborious to completely take in all of the impression.

Conclusion

In conclusion, I imagine buyers ought to be affected person and watch for a greater worth level. Ferrari continues to report upbeat development regardless of going through such a troublesome atmosphere. Because of its resilient buyer base, the demand for its automobiles stays very sturdy. The corporate is predicted to broaden its catalog by introducing 15 new automobiles within the coming 4 years, which embrace quite a lot of extremely anticipated launches reminiscent of its first-ever SUV and EV. Additionally it is persevering with to return money to buyers by means of dividends and buybacks, which is able to present extra help for its EPS because the share rely decreases. Nevertheless, the present valuation appears to be very stretched and provides little upside. There are additionally underlying dangers in regard to produce chain stability and foreign money headwinds. Subsequently I fee Ferrari as a maintain.

Supply hyperlink