It is solely pure that many traders, particularly those that are new to the sport, choose to purchase shares in ‘attractive’ shares with a great story, even when these companies lose cash. And of their examine titled Who Falls Prey to the Wolf of Wall Avenue?’ Leuz et. al. discovered that it’s ‘fairly widespread’ for traders to lose cash by shopping for into ‘pump and dump’ schemes.

In distinction to all that, I choose to spend time on firms like Asian Paints (NSE:ASIANPAINT), which has not solely revenues, but additionally income. Now, I am not saying that the inventory is essentially undervalued at the moment; however I am unable to shake an appreciation for the profitability of the enterprise itself. Conversely, a loss-making firm is but to show itself with revenue, and finally the candy milk of exterior capital could run bitter.

Try our newest evaluation for Asian Paints

How Shortly Is Asian Paints Growing Earnings Per Share?

When you consider that markets are even vaguely environment friendly, then over the long run you’d count on an organization’s share worth to observe its earnings per share (EPS). Due to this fact, there are many traders who like to purchase shares in firms which might be rising EPS. Asian Paints managed to develop EPS by 12% per yr, over three years. That progress charge is pretty good, assuming the corporate can stick with it.

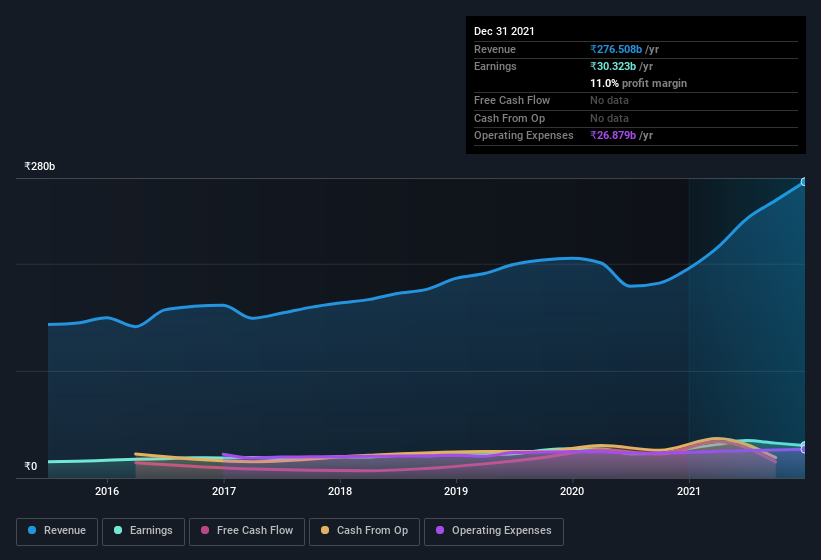

I like to try earnings earlier than curiosity and (EBIT) tax margins, in addition to income progress, to get one other tackle the standard of the corporate’s progress. Whereas Asian Paints did properly to develop income during the last yr, EBIT margins had been dampened on the similar time. So it appears the long run my maintain additional progress, particularly if EBIT margins can stabilize.

You may check out the corporate’s income and earnings progress pattern, within the chart under. To see the precise numbers, click on on the chart.

Fortuitously, we have got entry to analyst forecasts of Asian Paints’s future income. You are able to do your individual forecasts with out trying, or you’ll be able to take a peek at what the professionals are predicting.

Are Asian Paints Insiders Aligned With All Shareholders?

Like the children within the streets standing up for his or her beliefs, insider share purchases give me cause to consider in a brighter future. As a result of oftentimes, the acquisition of inventory is an indication that the customer views it as undervalued. Nonetheless, small purchases aren’t at all times indicative of conviction, and insiders do not at all times get it proper.

We’ve not seen any insiders promoting Asian Paints shares, within the final yr. So it is undoubtedly good that Thulaseedharan Nair purchased ₹1.2m price of shares at a mean worth of round ₹3,029.

The excellent news, alongside the insider shopping for, for Asian Paints bulls is that insiders (collectively) have a significant funding within the inventory. Notably, they’ve an infinite stake within the firm, price ₹261b. This means to me that management will likely be very aware of shareholders’ pursuits when making selections!

Is Asian Paints Value Holding An Eye On?

One constructive for Asian Paints is that it’s rising EPS. That is good to see. Higher but, insiders are vital shareholders, and have been shopping for extra shares. To me, that every one makes it properly price a spot in your watchlist, in addition to persevering with analysis. It is best to at all times take into consideration dangers although. Living proof, we have noticed 1 warning signal for Asian Paints try to be conscious of.

As a progress investor I do prefer to see insider shopping for. However Asian Paints is not the one one. You may see a a free checklist of them right here.

Please observe the insider transactions mentioned on this article seek advice from reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term centered evaluation pushed by basic knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Asian Paints is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Supply hyperlink